NetSpend has emerged as a leading provider of prepaid debit cards and financial services, catering to individuals who seek flexibility and control over their finances without the need for a traditional bank account. Whether you're looking to manage your budget, receive direct deposits, or avoid overdraft fees, NetSpend offers a range of solutions designed to meet your needs. With its user-friendly platform and robust features, NetSpend has become a go-to option for millions of people across the United States. This guide will explore the ins and outs of NetSpend, its benefits, and how it can help you take charge of your financial future.

As financial technology continues to evolve, NetSpend remains at the forefront of innovation, providing tools that empower users to handle their money with confidence. From its seamless mobile app to its reloadable prepaid cards, NetSpend ensures that users can access their funds anytime, anywhere. Whether you're new to prepaid cards or looking for an alternative to traditional banking, NetSpend's offerings are worth exploring. In this article, we’ll delve into the features, benefits, and potential drawbacks of using NetSpend, equipping you with the knowledge to make informed decisions.

NetSpend is more than just a prepaid card provider—it’s a financial partner that prioritizes accessibility and convenience. With no credit check required, it opens doors for individuals who may face barriers to traditional banking. As we navigate through this comprehensive guide, you'll discover how NetSpend works, who it’s best suited for, and how it stacks up against other financial solutions. By the end, you’ll have a clear understanding of whether NetSpend aligns with your financial goals and lifestyle.

Read also:Angel Bismark Curiel A Comprehensive Guide To The Rising Star

Table of Contents

- What is NetSpend and How Does It Work?

- Is NetSpend Right for You? Who Can Benefit?

- How to Get Started with NetSpend

- What Are the Benefits of Using NetSpend?

- NetSpend vs. Traditional Banking: A Comparison

- Can NetSpend Help You Build Credit?

- Frequently Asked Questions About NetSpend

- Conclusion: Why NetSpend May Be Your Financial Solution

What is NetSpend and How Does It Work?

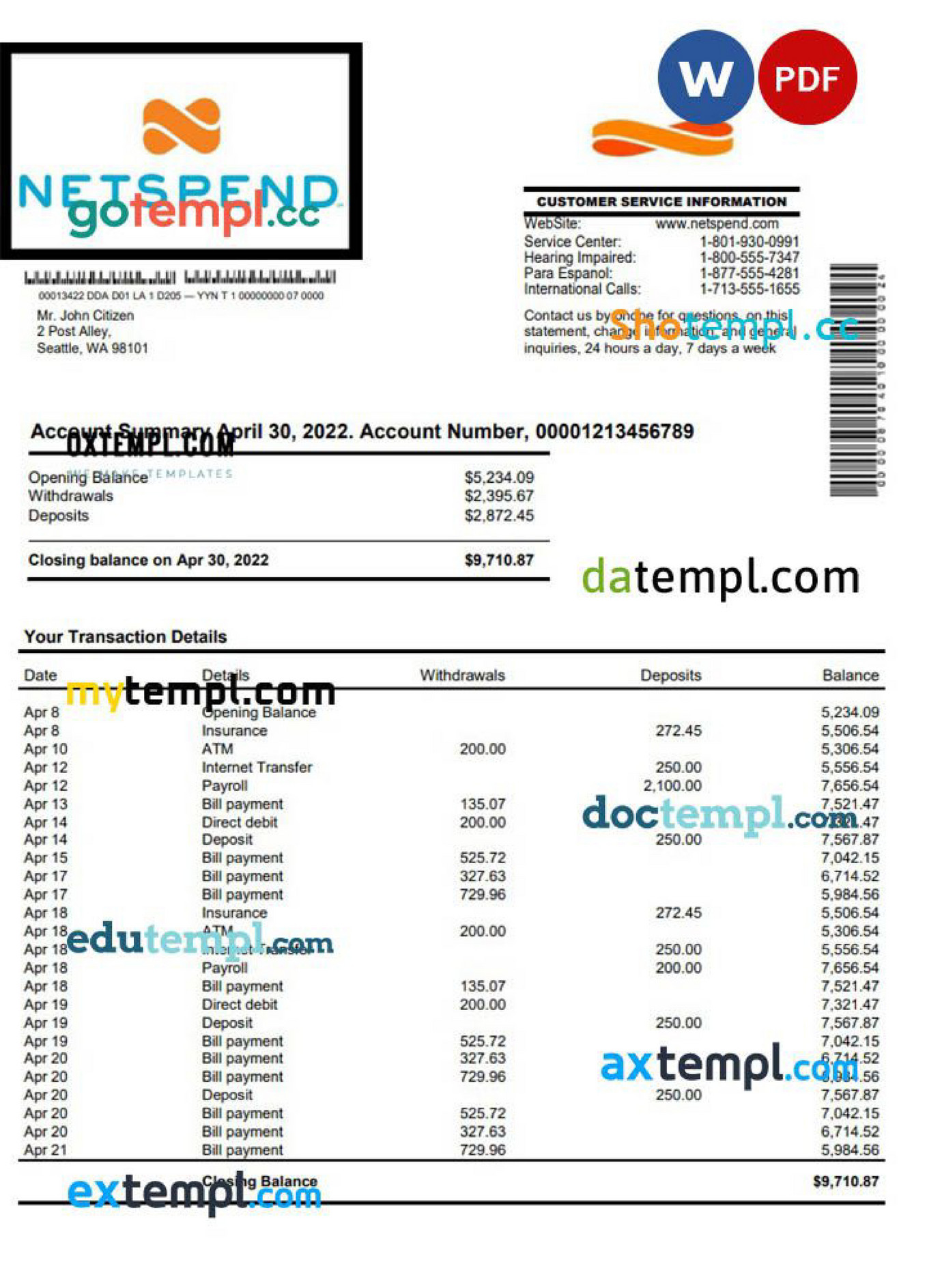

NetSpend is a prepaid debit card provider that allows users to manage their finances without requiring a traditional bank account. It operates under the umbrella of Total System Services (TSYS), a well-known financial services company. The primary function of NetSpend is to provide a reloadable prepaid card that can be used for everyday transactions, such as shopping, paying bills, and withdrawing cash from ATMs. Unlike credit cards, NetSpend cards do not involve borrowing money; instead, users load funds onto the card and spend only what they have available.

The process of using NetSpend is straightforward. Once you sign up for a card, you can load funds through various methods, including direct deposit, bank transfers, or cash reloads at participating retail locations. NetSpend cards are accepted wherever Visa or Mastercard is accepted, making them versatile for both online and in-person purchases. Additionally, users can access their account information through the NetSpend mobile app, which provides real-time updates on balances, transaction history, and spending patterns.

One of the standout features of NetSpend is its customizable plans. Users can choose between different fee structures, such as pay-as-you-go or monthly plans, depending on their usage habits. This flexibility ensures that individuals can select a plan that aligns with their financial needs and minimizes costs. Moreover, NetSpend offers additional features like overdraft protection and savings tools, which further enhance its appeal as a comprehensive financial solution.

Is NetSpend Right for You? Who Can Benefit?

NetSpend is designed to cater to a wide range of individuals, particularly those who may not have access to traditional banking services. Whether you’re unbanked, underbanked, or simply looking for an alternative to conventional banking, NetSpend offers features that can address your specific needs. However, understanding whether NetSpend is the right fit for you requires evaluating its benefits in relation to your financial goals and lifestyle.

NetSpend for Unbanked Individuals

For individuals without access to traditional banking, NetSpend provides a lifeline to financial inclusion. Without the need for a credit check or minimum balance requirements, NetSpend makes it easy for unbanked individuals to participate in the modern financial system. The prepaid card allows users to receive direct deposits, pay bills online, and make purchases securely, all without the need for a checking account. This accessibility is particularly valuable for those who face barriers to opening a traditional bank account, such as insufficient credit history or past banking issues.

NetSpend for Budget-Conscious Users

NetSpend is also an excellent option for individuals who are looking to manage their finances more effectively. The prepaid nature of the card ensures that users can only spend what they have loaded onto it, helping them avoid overspending and accumulating debt. Additionally, NetSpend’s mobile app provides tools for tracking expenses and setting budgets, empowering users to take control of their financial habits. For those who are budget-conscious, NetSpend offers a practical way to stay on top of their spending without the risk of overdraft fees or unexpected charges.

Read also:Jimmy Connors The Legendary Tennis Champion Who Redefined The Game

How to Get Started with NetSpend

Getting started with NetSpend is a simple and straightforward process. Whether you’re new to prepaid cards or transitioning from another financial service, NetSpend provides a seamless onboarding experience. Below, we’ll walk you through the steps to choose, activate, and fund your NetSpend card.

Choosing the Right NetSpend Card

NetSpend offers a variety of prepaid cards, each tailored to different needs and preferences. When selecting a card, consider factors such as the fee structure, features, and benefits. For example, some cards may offer cashback rewards or higher ATM withdrawal limits, while others may focus on low fees. It’s important to evaluate your spending habits and financial goals to determine which card aligns best with your needs.

Activating and Funding Your NetSpend Card

Once you’ve chosen a card, the next step is activation. This typically involves registering your card online or through the NetSpend mobile app. During the activation process, you’ll need to provide some basic personal information and verify your identity. After activation, you can fund your card using methods like direct deposit, bank transfers, or cash reloads at participating retail locations. NetSpend also offers a mobile check deposit feature, allowing users to add funds directly from their smartphones.

What Are the Benefits of Using NetSpend?

NetSpend offers a host of benefits that make it an attractive option for individuals seeking financial flexibility. From its user-friendly features to its accessibility, NetSpend provides a range of advantages that set it apart from traditional banking services. Let’s explore some of the key benefits that make NetSpend a popular choice among users.

One of the most significant advantages of NetSpend is its accessibility. Unlike traditional banks, NetSpend does not require a credit check or minimum balance to open an account. This makes it an ideal solution for individuals who may face barriers to traditional banking, such as insufficient credit history or past banking issues. Additionally, NetSpend’s prepaid cards are accepted wherever Visa or Mastercard is accepted, providing users with the flexibility to make purchases both online and in-store.

Another benefit of NetSpend is its focus on financial control. The prepaid nature of the card ensures that users can only spend what they have loaded onto it, helping them avoid overspending and accumulating debt. Furthermore, NetSpend’s mobile app provides tools for tracking expenses and setting budgets, empowering users to take control of their financial habits. For those who are budget-conscious, NetSpend offers a practical way to stay on top of their spending without the risk of overdraft fees or unexpected charges.

NetSpend vs. Traditional Banking: A Comparison

When evaluating financial solutions, it’s important to compare NetSpend with traditional banking services to determine which option best suits your needs. While traditional banks offer a wide range of services, including loans, credit cards, and investment accounts, NetSpend focuses on providing a simple, accessible, and flexible prepaid card solution. Let’s explore the key differences between NetSpend and traditional banking to help you make an informed decision.

One of the primary distinctions between NetSpend and traditional banking is the accessibility factor. Traditional banks often require credit checks, minimum balance requirements, and extensive paperwork to open an account. In contrast, NetSpend eliminates these barriers, making it an ideal option for individuals who may not qualify for a traditional bank account. Additionally, NetSpend’s prepaid cards do not involve borrowing money, which reduces the risk of accumulating debt.

Another key difference lies in the fee structures. While traditional banks may charge monthly maintenance fees, overdraft fees, and other hidden charges, NetSpend offers transparent fee plans that users can customize based on their usage habits. This transparency ensures that users can minimize costs and avoid unexpected expenses. However, it’s worth noting that traditional banks may offer additional services, such as interest-bearing accounts and investment opportunities, which NetSpend does not provide.

Can NetSpend Help You Build Credit?

One common question among NetSpend users is whether the service can help build credit. While NetSpend is not a credit-building tool in the traditional sense, it does offer features that can indirectly contribute to improving your financial profile. Let’s explore how NetSpend can play a role in your journey toward better credit.

NetSpend’s prepaid cards do not report to credit bureaus, meaning they won’t directly impact your credit score. However, by using NetSpend to manage your finances responsibly, you can develop healthy financial habits that lay the groundwork for credit improvement. For example, the card’s budgeting tools and spending controls can help you avoid overspending and manage your money more effectively. Additionally, NetSpend’s direct deposit feature allows users to receive paychecks and government benefits earlier, which can help them stay on top of their financial obligations.

While NetSpend itself doesn’t build credit, it can serve as a stepping stone toward financial stability. By using the card responsibly and avoiding debt, users can position themselves for future credit opportunities, such as secured credit cards or loans. For individuals looking to improve their financial standing, NetSpend provides a practical starting point.

Frequently Asked Questions About NetSpend

Here are some of the most common questions users have about NetSpend, along with detailed answers to help you better understand the service.

Is NetSpend Safe to Use?

Yes, NetSpend is a safe and secure financial solution. The company employs advanced encryption and fraud protection measures to safeguard users’ personal and financial information. Additionally, NetSpend’s prepaid cards are backed by Visa or Mastercard, providing an extra layer of security for transactions.

Can I Use NetSpend Internationally?

NetSpend cards can be used internationally wherever Visa or Mastercard is accepted. However, users should be aware of foreign transaction fees and ATM withdrawal fees that may apply when using the card outside the United States.

How Do I Contact NetSpend Customer Support?

NetSpend offers customer support through multiple channels, including phone, email, and live chat. Users can also access a comprehensive FAQ section on the NetSpend website for quick answers to common questions.